Severe weather: For urgent assistance call 0800 800 134.

Submit your claim online here. General FAQ's at Wild Weather Hub.

VERO SME

INSURANCE INDEX

2022 Edition - Issue 2

Find out what SMEs

value from a broker

or adviser

Insights from the latest Vero SME Insurance Index

About the 2022 Vero SME Insurance Index

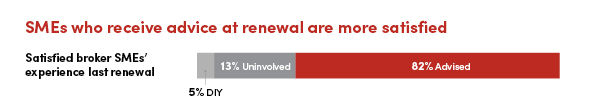

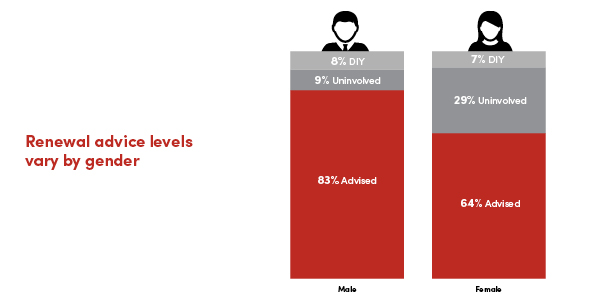

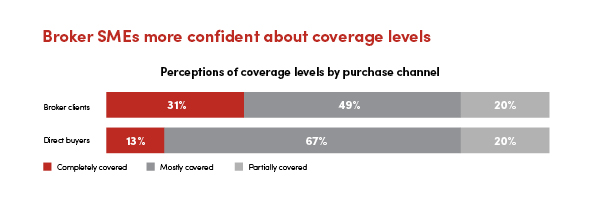

The second issue of the 2022 Vero SME Insurance Index shares insights on SMEs behaviour at renewal time as well as shining a light on their attitudes towards risk.

The report research provides in-depth insights on the below topics:

- Renewals as an insurance moment of truth

- The risk of inadequate cover and underinsurance

Social Media Highlights

2022 Insurance Index

Here are some highlight videos you may share on social media to interact with and engage your audience.

Strong Relationships

The tools to help you

Our Risk Management specialists have updated the Vero Risk Profiler to include information on ways to minimise property damage caused by a natural disaster. Find this information in the specific risk section under Natural Events.

The Vero Risk Profiler provides a wealth of information on typical business risks including claims stats, guides, checklists and in-depth information on high risk activity. You can find the Risk Profiler here.

View all issues

View all the customer insights from each issue of the Vero SME Insurance Index. These insights will help build a deeper understanding of commercial insurance for SMEs in New Zealand.

Insurance policies made for SMEs

Keep reading

Vero Voice Blog

Protecting your business from interruption

One of the big concerns for many business owners is what would happen if your premises were damaged severely and you weren’t able to trade for several months, or even years. One way to give yourself peace of mind is to have Business Interruption insurance.

Read blog