Severe weather: For urgent assistance call 0800 800 134.

Submit your claim online here. General FAQ's at Wild Weather Hub.

Vero Voice Blog

Wet Weather Lessons: Small Claims, Big Takeaways

30 June 2025

Extreme weather events are becoming more frequent and severe across Aotearoa. Despite the growing risks posed by storms and flooding, and even with advance weather warnings, many homeowners have yet to take the necessary steps to storm-proof their properties.

Another destructive bout of flooding swept through the country in April, adding to what’s begun to feel like a regular pattern. That single event triggered over 1,000 Vero insurance claims, most of which were low-value: roof leaks, damaged fences, and minor cosmetic issues. While these may seem like “small” claims, they carry a big message for both brokers and customers.

In a climate where heavy rainfall and rising sea levels mean flooding is only set to increase, a little prevention can go a long way toward reducing stress, and cost.

First, prevention pays off. Many of these losses could have been reduced or avoided completely through basic property maintenance. Loose flashings, overgrown trees, and rotting fence posts turn routine rain into a claim. Encouraging customers to stay on top of upkeep is a simple but impactful form of risk management.

Know what’s covered. Events like this often expose confusion around policy scope, especially for non-structural items like driveways, garden walls, and sheds. Brokers play a crucial role in guiding customers through what is (and isn’t) covered before a claim arises.

Documentation is gold. Quick claims require good evidence. Encouraging customers to photograph their property periodically and keep receipts for key improvements can speed up settlements when time matters most.

Responsibility goes both ways. Flood risk is a shared problem. An unsecured shed, an overflowing gutter, or a leaning tree on one property can become the neighbour’s loss. Remind clients that maintaining their property protects the whole street. Shared resilience starts with each property owner doing their part.

Debrief with your customer. Following up with clients after heavy rainfall and flooding is a perfect opportunity to add value. Once repairs are underway, it’s an opportunity for brokers to discuss with clients what happened, review their cover, and share practical tips to reduce future risk. This could mean suggesting a home inspection checklist or introducing them to resources like Vero’s Risk Profiler guides on weather preparedness. A little guidance now helps customers feel prepared for the next flood and shows you're there for more than just advice on claims.

In a world of rising flood risk, every small lesson counts.

Thanks to Vero’s partnership with Morgan Project Services (MPS) and its unique Project Management Office (PMO) model, we’re able to capture transparent, claim-level data and extract meaningful insights in real time. This structure allows Vero to identify patterns quickly - like the prevalence of low-value but preventable flood-related claims - and pass these learnings on to brokers to support better customer outcomes.

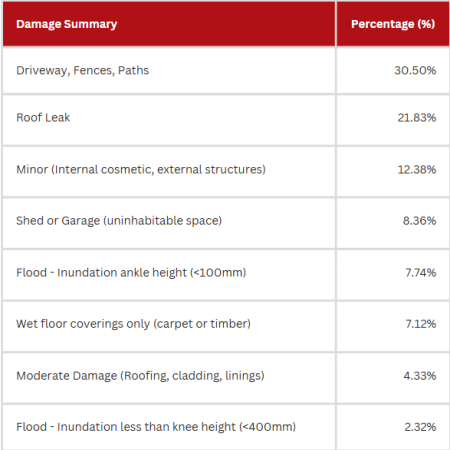

The April flood claims breakdown below shows just how often minor maintenance oversights lead to avoidable damage. As trusted advisers, brokers have a unique opportunity to help customers turn flood fatigue into future resilience. After all, preventing a garage from flooding is far better than claiming on one later.

If you don’t have an insurance broker and you’re wanting to get in touch with one, you can find a list of brokers near you via our Vero Broker Locator.

The information in this article has been compiled from various sources and is intended to be factual information only. Full details of policy terms and conditions are available from Vero Insurance New Zealand Limited or your financial adviser. For advice on product suitability, please contact your financial adviser. While we take reasonable steps to ensure that the information contained in this article is accurate and up-to-date, it is subject to change without notice. Vero Insurance New Zealand and its related companies does/do not accept any responsibility or liability in connection with your use of or reliance on this article.